By Agatha Christie Akello

The university experience is a test drive of what your independent adult life will look like. From the friends you keep, to the places you frequent, and the discipline to do the right thing without instant gratification, the ball is in your court. Thanks to our conservative system, this is also the first time the majority of us meet money.

I know what you’re thinking. You always got pocket money in high school and sometimes your parents trusted you to bank your fees and do your own school shopping; but I can assure you that managing your finances in a way that ensures you lead a decent quality of life is far from getting stipends for when you’re not interested in school meals.

When I talk about meeting money, I am referring to the ability to make it, grow it and spend it in a way that simplifies your life.

If you are lucky enough to only worry about coursework and assignments at the university because your parents or guardians are capable of fully catering to your basic needs, call them right now and say “Thank you!” I do not mean to sound like “there are children starving in Africa”, but you need to understand how much of a privilege it is that you do not have to worry about tuition, hostel fees, food and learning materials. Which also means you will meet money as a tool you exchange for value, not some mystical object you have to do absurd things to obtain.

To be honest with you, I was a total airhead in regards to my finances back at campus. I am barely good with money as we speak; but if I have learnt anything in my few years of independence, it’s that money is energy, and while it comes and goes, you will feel a lot better if you use your money wisely.

Fortunately, I was one of the lucky students who had supportive parents. My tuition and hostel fees were paid in full along with a weekly allowance. Like you and some of my IG friends who responded to the question tag on my stories, we knew little about financial management while at university. In retrospect, this is what we would do better with our campus funding:

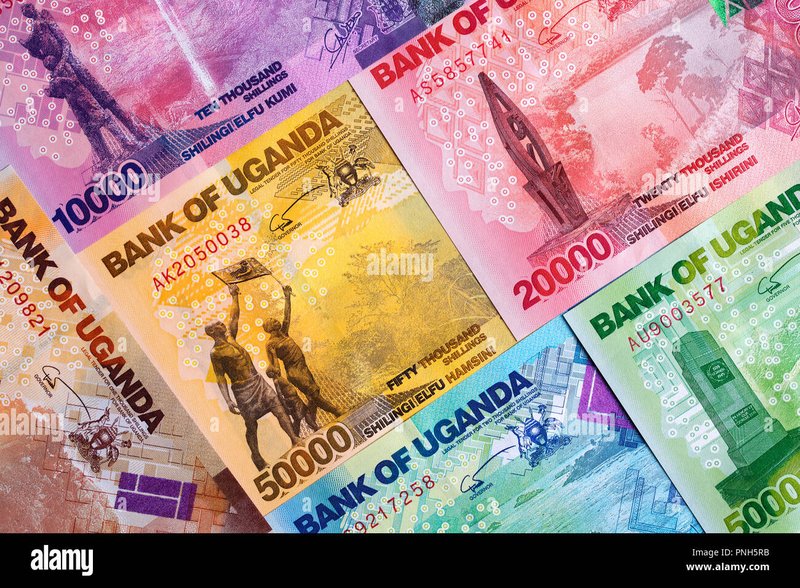

- Save some of the money we got. You are broke because you spend all your money. What I have learnt is that saving without a goal is quite tasking. If you are like me and your body itches when there’s money in your account, consider joining a savings group or starting one. If you have, say, five trustworthy friends each getting Shs100,000 weekly, commit to giving Shs20,000 to a weekly cash round. This means you will have an extra Shs80,000 at some point every month. You can then look into the UAP Umbrella Trust Fund and remit Shs100,000 to it when it’s your turn to get cash. Do I make sense? If you save your Shs100,000 monthly for the 3/4 years you are at campus, you will be lightyears ahead of your peers.

- Invest in good friendships. The company you keep will make or break you, because you cannot rise above your associates. The aforementioned cash round will not work if you are surrounded by people who strongly believe in YOLO. While you only live once, there is a higher chance that you will be around for 40 or so more years. Besides, a good circle of friends will help you enjoy life on a budget. You can uber to the party together, you can kwesonda and travel together, you can cook and eat together during black November. A life shared is a life well lived.

- Learn contentment. As you know by now, university pools people from different walks of life. With the way the majority of us stay glued to a phone screen, I can only imagine what social media has done to the brain chemistry of impressionable and idealistic students. It is often said that comparison is the thief of joy, but I am rewiring my mind to say “Comparison is a source of inspiration”. In my view, comparison can serve as an example of what discipline and consistency can birth. Contentment is knowing that as long as you’re doing the right thing, everything good is coming. Relax, be content, work for better.

- Learn a skill. Besides the fact that I can spell “simultaneously” without checking google, or win any application that requires an essay, writing is one of the most valuable skills I have learnt. I am guaranteed a monthly supplementary income just because I can articulate my thoughts on paper. What's more, you need writing to ace your exams. My point being, if you are to work and study, find a skill that ties into your program. That way you’re learning and earning at the same time. You can also learn how to speak publicly, there is obscene money in emceeing. Content creation is another multimillion industry. All you need is high-level audacity, excellence in all you do, and the willingness to show up consistently for your skills to monetize.

- Start building good habits now. Exercise your discipline muscle. Attend your classes, do your coursework, save when you should, workout. It is a lot harder to learn things when you’re older because there is no time and you’re riddled with rejection. Be curious, read about money, research things that tickle your fancy, open up to the possibility of life going your way!

Bonus: Do not give all your money to your boyfriend! It is worth mentioning that this is something my friend deeply regrets. Let me tell you something, I do not care how much of a lover girl you think you are, but carrying your parents’ money and giving it to your boyfriend is diabolical! We have been through this. Imagine simultaneously dealing with a heartbreak along with the realization that he was using your funds to woo other girls (which is most likely what he’s using your money for)! I repeat, do not give your pocket money to a love interest. It has never had a positive outcome. Do you want to be on podcasts romanticizing struggle love just to validate your experience? Exactly!

While I would not change my campus experience, I would change some of my habits like blowing through my funds in days and not taking the time to actually read about and change my perception of money. Don’t be like me, start now. All the best!

Related News

![]() Please join hands with the Makerere University Endowment Fund as it works towards attracting & retaining the best faculty, providing scholarships, and investing in cutting-edge research and technology.

Please join hands with the Makerere University Endowment Fund as it works towards attracting & retaining the best faculty, providing scholarships, and investing in cutting-edge research and technology.